10 French Startups to Watch in 2022

Table of contents

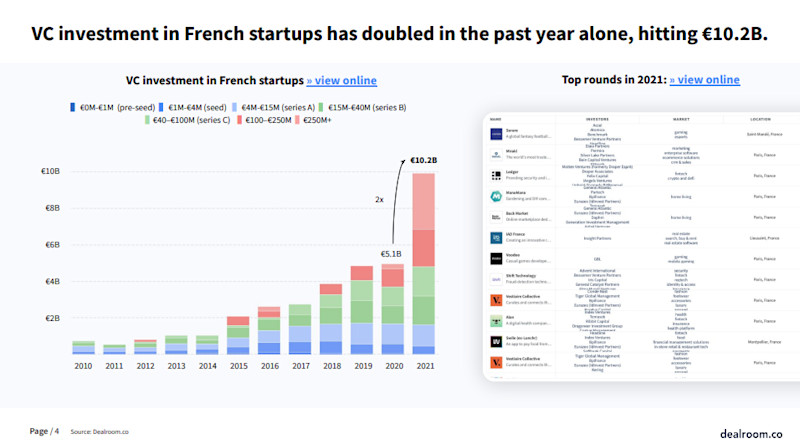

2021 was a great year for French startups. According to a report by Dealroom in partnership with La French Tech, venture capital investments in French startups have doubled in the past year alone, going from $5.8 billion (5.1 billion euros) to over $11.3 billion (10 billion euros) in 2021. In parallel, the combined enterprise value of French startups founded since 2000 was $204 billion (179 billion euros) in 2021, which is 17.7 times more than in 2010.

2021 was a great year for French startups. According to a report by Dealroom in partnership with La French Tech, venture capital investments in French startups have doubled in the past year alone, going from $5.8 billion (5.1 billion euros) to over $11.3 billion (10 billion euros) in 2021. In parallel, the combined enterprise value of French startups founded since 2000 was $204 billion (179 billion euros) in 2021, which is 17.7 times more than in 2010.

With 31 French companies with billion-dollar valuations, the country has also now surpassed Sweden and the Netherlands in number of unicorns, coming only second to Germany (53). Per the report, the country is also creating unicorns faster than most European ecosystems.

The Org has identified 10 French startups with impressive sales figures or funding rounds that should grab headlines in 2022.

1. Lydia

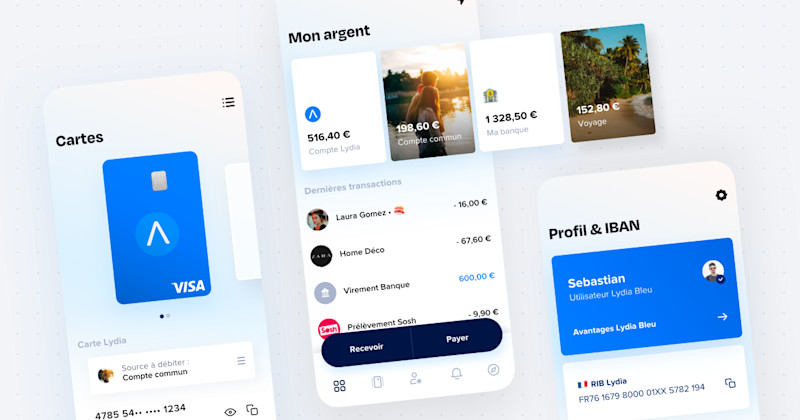

Fintech startup Lydia has been growing at a rapid pace. With its latest funding round, a whopping $100M Series C round raised from international investors such as Accel and Tencent, the company has joined the selective club of French startup unicorns.

Over the years, the Lydia team has expanded the product beyond its original use case. Created in 2011 to facilitate money movements through its peer-to-peer mobile app, the startup now offers all the services of a regular bank: saving accounts, debit cards, small loans and now trading.

Used by more than 5.5M people, mostly between 18 and 35 years old, Lydia intends to simplify access to finance by enabling every Lydia account holder to trade shares as well as cryptocurrencies. Its partnership with Bitpanda allows Lydia to offer fractional shares so that anyone can buy any portion of the shares available on the app.

2. La Belle Vie

End of 2021, daily products delivery startup La Belle Vie announced a new funding round of $28.5 million (25 million euros) after the business suddenly soared with the wave of confinements during the first year of the pandemic. In 2021, the company reached $91 million (80 million euros) in sales and a 101% yearly growth.

The company, founded in 2015, counts 17,000 items in its catalog, ranging from fresh produce to detergent to baby diapers, and can deliver in the region Ile-de-France in less than three hours. With 20,000 clients, La Belle Vie recently launched its super-fast delivery service coined "BAM course" to deliver orders among 2,500 items within 15 minutes.

The team, which counted 500 members at the end of 2021, should reach 1,000 employees by mid-2022.

3. Ornikar

Founded in 2013, Ornikar broke the status quo of the obscure market of driving licenses owned by driving schools. Ornikar offers to learn traffic regulations and prepare for the national exams online, instead of having to go to a physical classroom at the driving school one signed up for.

The startup managed to bring the driving license to the 21st century and offers an alternative to regular driving schools which are characterized by high fees, hidden costs, numerous frictions to take the exams as well as poor quality teachers. It also offers driving classes with a roster of 1,700 independent teachers that can come pick up students at one of the numerous meeting points located in the 1,000 cities in which the startup operates.

Ornikar has managed to capture a big share of the market fast: Out of the 1,2 million people who took the traffic regulations exams in 2020, 420,000 of them were Ornikar students. Their students’ collective 88% success rate at the exam makes Ornikar a very compelling option for willing-to-be drivers.

The startup, which reached $51.3 million (45 million euros) in revenue in 2020, raised $114 million (100 million euros) from KKR and has recently expanded its offer with its new car insurance.

4. sunday

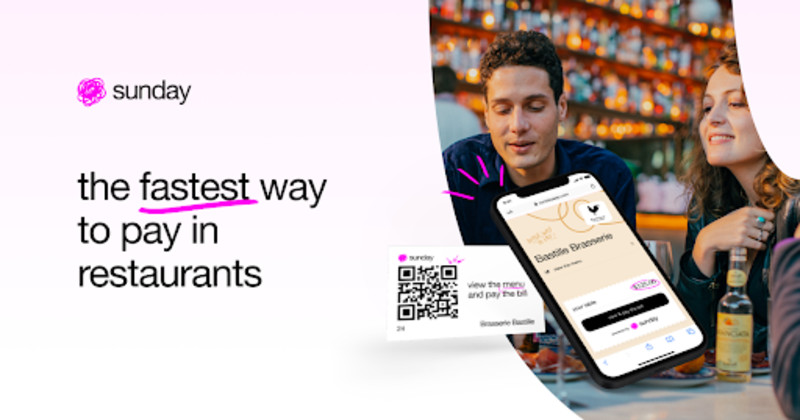

Founded by Victor Lugger and Tigrane Seydoux who created the European restaurant group Big Mamma, as well as Christine de Wendel, sunday aims at simplifying the payment process for restaurant customers.

Influenced by the COVID-19 pandemic and the new regulations and habits that came with it, the service allows clients to pay the bill in less than 10 seconds thanks to QR codes. Making it faster to pay the check enables restaurant teams to better focus on the quality of their service. Per the startup, using their technology allows for a 10% faster table turnover.

The startup, founded in 2020, reached 1 million users and 1,500 client restaurants in just one year. The smooth experience has allowed its roster of restaurants to reach over $1 million (800 thousand euros) in tips given through the app, which is 40% higher than without the app. Last September, it announced a new $100 million Series A funding round and that it intends to grow its international team to strengthen its business in France, Spain, the U.K., the U.S., and Canada.

5. Papernest

Tracking, updating or canceling one's subscriptions can be cumbersome, especially when you move to a new address. The idea of Papernest came to cofounder Philippe de la Chevasnerie when he moved out: Realizing that service subscriptions had taken over owning things, he found himself with many subscriptions to deal with.

Now, with the Papernest platform, anyone can easily cancel or update their home insurance, utility contracts, Internet and media subscriptions or set up mail redirection. To fuel its growth, the startup has partnered along the way with real estate agency group Century 21 to support clients when they're moving.

The startup, which counted 200,000 users in 2018, is now used by more than 800,000 clients per the company’s website. The team counts 600 employees across multiple offices in France, Spain and Italy.

6. Libeo

Libeo makes it easy for SMEs to process supplier invoices. When most businesses still print out invoices and pay them manually by bank transfer or cheque, the startup digitizes and centralizes everything on its online platform. No need to enter an IBAN across multiple websites: With smart approval workflows, team members can proceed to one-click payments as well as monitor real-time cash flows.

In 2020, the startup counted 35,000 companies that processed altogether $114 million (100 million euros) during the year. It raised $23 million (20 million euros) in Series A funding from LocalGlobe, DST Global, Serena, and Breega in 2021.

7. Skello

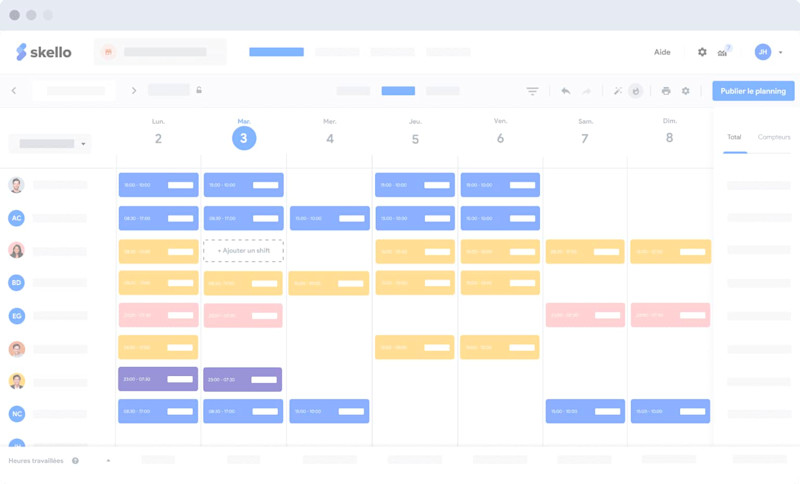

The Paris-based startup Skello offers intelligent planning and staff management tools originally destined to stores and restaurants.

When most of their clients found themselves forced to shut down during the multiple periods of confinement, the young company had to pivot and adapt. The team successively moved to the retail and healthcare markets - the business was met with a 200% growth rate on the retail vertical in 2020, and restaurants and hotels went from representing 90% of their activities to 60%.

Founded in 2016, the company raised a Series B funding round of $45 million (40 million euros) last September from Partech, XAnge and Aglaé Ventures. With 7,000 businesses as clients, the team intends to reach 500 employees by 2023 and is now expanding in new countries such as Spain and Germany.

8. 360Learning

360Learning wants to make peer-to-peer learning easier. Such internal resources are both instrumental and strategic to companies when they onboard new employees, launch new training classes or design internal mobility programs.

With the 360Learning platform, any employee is empowered to create courses from scratch. There's no need to master video editing or to be an education expert: anyone can easily capture videos, upload files, add Youtube links, documents, or any materials. Feedback and completion rates let admins track the quality of the course and adjust its content consequently.

As collaborative learning and onboarding become essential at a time where remote work is booming, the startup is getting a lot of traction. The startup has convinced 1,500 companies to use their platform and is growing at a rapid pace in the U.S. where it launched in 2019. It raised $200 million in October 2021 from Sumeru, SoftBank’s Vision Fund 2 and Silver Lake Waterman.

9. Alma

Businesses can grow their revenue by allowing clients to pay in several times or even later. That's the hypothesis behind French startup Alma: Launched in 2018, the startup advances funding to e-commerce companies when clients opt-in to pay in several installments, and earns a commission at every step of the reimbursement process, from 3.8% for payments in three times to 4.2% for payments in four times.

The service is easy to implement within just a few clicks, and allows online businesses to reach new segments of clients, convert and retain them better, as well as grow the overall customers' satisfaction.

When e-commerce boomed during the confinements of 2020, Alma was on the front line to grab the benefits of it but certainly needed a lot of cash to meet its growth target. The startup raised $34 million (30 million euros) in March 2020 before raising a $55 million (49 million euros) Series B funding round a year later.

In June 2021, it announced a securitized mutual fund to finance merchants — the B2B opportunity is even bigger than B2C e-commerce and could drive the startup’s path to success and profitability.

10. Pennylane

Pennylane’s ambition is to become the destination financial management and accounting platform for SMEs and their accountants. The platform centralizes companywide financial data in real-time to let business owners make better decisions based on smart insights. It also frees up accountants from chasing data and paperwork and helps them focus more on their consultancy expertise.

French startup Pennylane seduced world-class Silicon Valley investor Sequoia into funding its laster round. With $15 million raised in June 2021, the company wants to reach new clients. Instead of investing heavily in marketing, the team has been going through networks of certified public accountants to reach new SME clients.

Create your own free org chart today!

Show off your great team with a public org chart. Build a culture of recognition, get more exposure, attract new customers, and highlight existing talent to attract more great talent. Click here to get started for free today.

In this article

The ORG helps

you hire great

candidates

Free to use – try today