Five French Fintechs to Look Out For in 2021

Table of contents

The fintech ecosystem in France has slowly but surely matured over the past decade. The Org has identified five promising fintechs from France that have shown impressive sales figures, expanded their team at a high pace, or raised important funding from investors.

The fintech ecosystem in France has slowly but surely matured over the past decade. Even the turmoils of 2020 didn't prevent the market from reaching new records. Last year, French fintech startups raised 828.2M€ ($998M) across 63 companies, a leap of more than 18% compared to 2019. The average investment was 13.1M€ ($16M, up 20.6% v.s 2019), while two startups raised massive VC funding rounds: a Series C of 104M€ ($135M) for Qonto and a Series B of 112M€ ($135M) raised in two tranches for Lydia.

With 178.4M€ ($215M) raised by French fintech startups in January 2021, the industry is already off to a good start. This growing appetite from investors is linked to the bullish trend in the M&A market. Between 2015 and 2019, 20 mergers or acquisitions happened in the industry. Many major French banks have acquired a fintech business: In 2017, Pumpkin (a P2P payment mobile app) was acquired by Crédit Mutuel for an undisclosed amount, and Compte Nickel (a no-minimum neobank) by BNP Paribas for more than 200M€ ($240M). Last June, Shine (a bank account and personal assistant for freelancers) was bought by Société Générale for a reported 10.6M€ ($13M).

The Org has identified five promising fintechs from France that have shown impressive sales figures, expanded their team at a high pace, or raised important funding from investors.

1. Bankin'

Bankin' arrived in 2011 to help people better manage money directly from their smartphones. At that time, most French banks didn't have a mobile app for their customers, or even if they did, the product was very far from any standard of user-friendliness. The tardiness to embrace the mobile digitalization wave left a wide corridor for Bankin'.

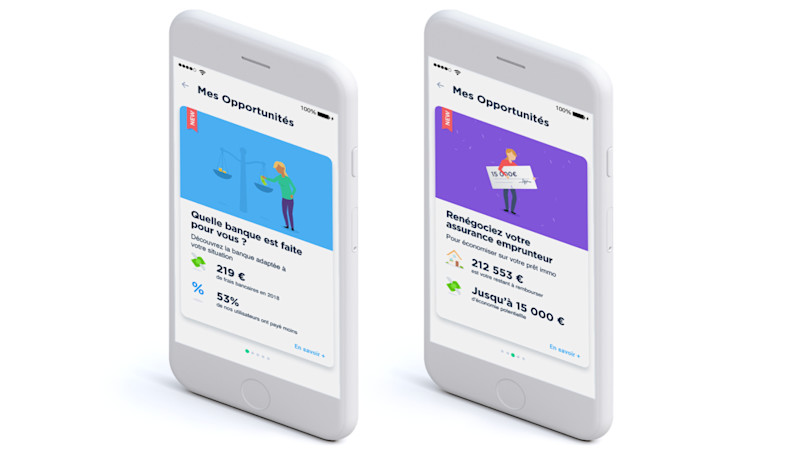

After plugging in their bank information, users have every transaction automatically analyzed and labeled by categories on the Bankin' mobile app. This allows users to access an overview of their spending habits in a nutshell, and to set up a strategy for managing a budget or saving money.

In 2018, a European directive required banks to share the payment data of their clients to third-party services, which led Bankin' to create Bridge, a B2B brand developing an API for other companies to safely access that data and build financial services on top.

The company, which counts 4.4M users and more than 100 employees, is based in Paris and has raised around 30M€ ($36M) since inception.

2. Lydia

Lydia is the equivalent of Venmo in France. Founded in 2011, only two years after its American counterpart, the company similarly enables money movement through its dedicated peer-to-peer mobile app without entering an account number (only a phone number is needed).

Since the launch of its mobile app in 2013, the now 300-employee company has progressively extended its range of services. For example, users can now use Lydia to pay online or in stores. They can open a Lydia bank account too. In 2019, the app counted 2 million accounts.

The founders announced a capital injection of 131M€ ($158M) in December 2020 as part of its Series B round. International investors such as Accel and Tencent joined the round, proving that French fintech startups can attract the favors of prestigious international investors.

3. PayFit

Focused initially on payroll automation, PayFit now covers many internal HR-related aspects such as onboarding, expenses, leaves, and absences. Offering simplicity, transparency, and flexibility to both employees and HR managers, the platform is already used by more than 5,000 companies across Europe, according to the company’s website.

PayFit, which counts 500 employees, has raised 89.5M€ ($108M) in total, including a 70M€ ($84M) Series B round with American investors Accel and First Round Capital, among others.

Lately, PayFit has multiplied strategic partnerships with other startups targeting similar clients to integrate products and remove all friction from its user experience. It's also an opportunity for the company to tap into the pool of clients of their partners, such as Qonto, a French neobank focused on SMEs, or Alan, a digital complementary health insurance.

4. October

Last September, this SME lending marketplace announced a 358M€ ($300M) debt round dedicated to financing new loans on its platform.

Targeting startups in France, Spain, Italy, Netherlands, or Germany, October can send loan offers from 30k€ ($36k) to 5M€ ($6M) just a few days after a business applies. It's basing its risk assessment on data analysis as well as traditional human analysts.

A tranche of 23M€ ($28M) from its latest round is dedicated to traditional SME loans, and 232M€ ($280M) will be invested in Italian SMEs through government-backed loans (Italian bank Sanpaolo Group is investing exclusively in this fund).

Founded in 2014, the company has granted 1,000 loans since inception and counts 108 employees.

5. Shift Technology

Detecting insurance fraud has become increasingly difficult due to more sophisticated criminal schemes. The estimated cost of those frauds in France is 2.5Bn€ per year. Shift Technology uses an AI detection model to build out the important data sets that uncover those frauds. The company works with major insurance companies from more than 25 countries, like MACIF in France or CNA in the U.S., and in 2019, said it was working with more than 70 clients.

The team counts near to 300 employees based between the Parisian office and other locations across Europe, North American, and Asia.

--

The Org is a professional community where transparent companies can show off their team to the world. Join your company here to add yourself to the org chart!